Dec 24th, Panama –According to an announcement by a cryptocurrency exchange platform, Gate.io and...

ZX3.io is thrilled to announce its official launch today! As the newest addition to the...

Geneva, Switzerland – Coinomi, a trusted leader in secure, multi-chain cryptocurrency wallets since 2014,...

SAN FRANCISCO, December 17, 2024 — Saga, the Layer 1 blockchain protocol to launch...

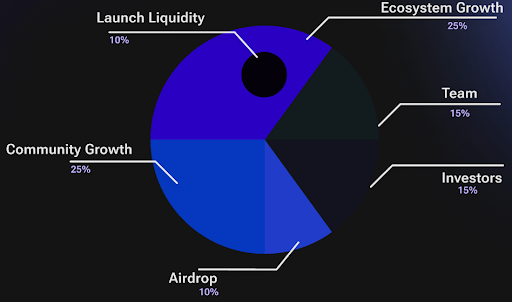

Streamflow is excited to announce the launch of the STREAM token, marking a transformative...

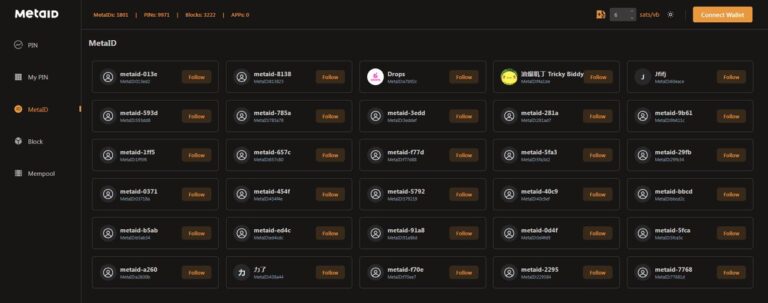

Bull Market Narrative Returns to the BTC Ecosystem: MetaID Aims to Build a Billion-Dollar Web3 World

The current crypto market is seeing a clear narrative shift back to the Bitcoin...

With user-friendly interfaces and seamless integration with tomi’s decentralized ecosystem, tomi Storage offers users...

November 2024 – As decentralized finance (DeFi) continues to disrupt traditional financial systems, Definder...

PEPE joins forces with AI to launch DrPepe.ai on Solana ...

BUENOS AIRES, Argentina, November 15, 2024 — Flixxo, the independent content streaming platform, has...