In the rapidly evolving field of digital asset trading, what truly constitutes the core...

A lot of crypto miners get to make a choice very early on, where...

While most leading cryptocurrency exchanges in 2025 have focused on tokenized equities and intensified...

Recently, ENI announced strategic partnerships with two influential Japanese institutions—NTT Digital, a core subsidiary...

The narrative that memecoins are fading couldn’t be further from the truth as we...

The digital asset landscape in Asia is undergoing a profound transformation, and at its...

A New Era of Competition Unfolds Inside Circolo House, Singapore Singapore, October 2, 2025...

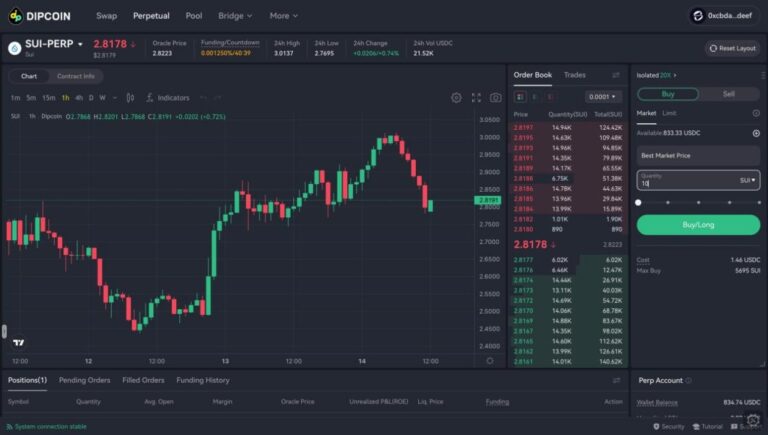

Singapore, October 15, 2025 — DipCoin.io, a next-generation decentralized trading platform built on the...

Aivora: Voucher System Upgrade Heads up, fam! Aivora is leveling up our entire trading...

Trading has changed dramatically in the past few years. Crypto markets never sleep, price...